Chamath Palihapitiya’s net worth has become a widely discussed topic in the worlds of technology, venture capital, and finance. Known as a bold investor and outspoken Silicon Valley figure, Palihapitiya rose to prominence after playing a key role in Facebook’s early global expansion before launching his own investment firm, Social Capital. Over the years, he has built a reputation for making high-risk, high-reward bets—most notably through venture capital investments and high-profile SPAC deals that reshaped public market investing.

While estimates of Chamath Palihapitiya’s net worth vary significantly, his financial journey reflects the volatility of modern tech wealth. Market cycles, startup valuations, and public stock performance have all influenced his fortune. From billionaire status at his peak to periods of sharp valuation declines, his wealth story is anything but static. This article explores how Chamath Palihapitiya made his money, how much he is worth today, and what factors continue to shape his net worth.

Quick Facts About Chamath Palihapitiya

Chamath Palihapitiya is a Canadian-American venture capitalist, entrepreneur, and former technology executive best known for his bold investment style and outspoken views on business and society. He was born on September 3, 1976, in Sri Lanka, and immigrated to Canada with his family at a young age. His early life as an immigrant played a significant role in shaping his worldview, ambition, and appetite for risk.

He earned a degree in Electrical Engineering from the University of Waterloo, one of Canada’s top technical universities. After graduating, Palihapitiya began his career in the technology sector, holding early roles at companies such as AOL, where he worked on the Winamp music platform. These early experiences gave him exposure to fast-growing internet businesses before the rise of social media.

Chamath Palihapitiya gained widespread recognition after joining Facebook in 2007, where he eventually became Vice President of User Growth. His work helped Facebook scale globally, and the equity he earned during this period laid the foundation for his future wealth. After leaving Facebook in 2011, he founded Social Capital, a venture capital firm focused on long-term value creation across technology, healthcare, education, and financial services.

Today, Palihapitiya is also widely known as a co-host of the All-In Podcast, where he discusses markets, startups, politics, and economic trends. His career spans venture capital, public markets, media influence, and philanthropy, making him one of the most recognizable—and debated—figures in modern Silicon Valley.

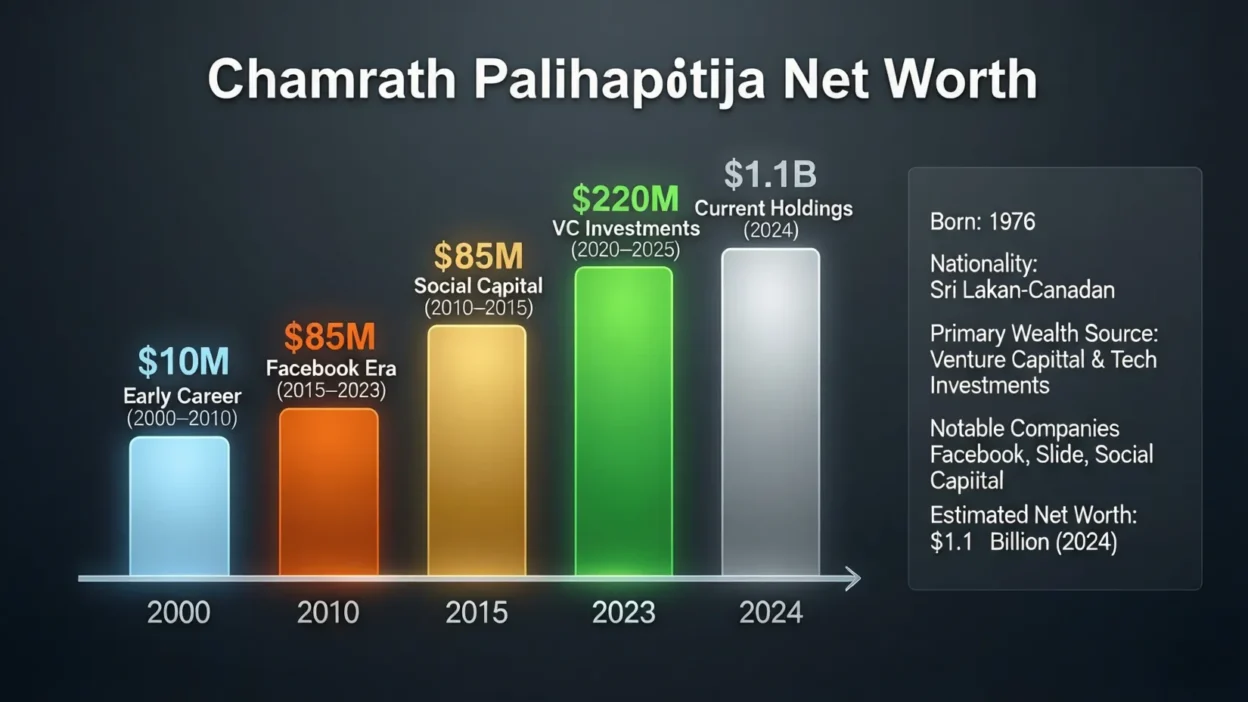

Chamath Palihapitiya Net Worth

Chamath Palihapitiya’s net worth has fluctuated significantly over the years, making it difficult to pinpoint a single, definitive figure. As of recent estimates, his net worth is generally believed to fall within a broad range of approximately $600 million to over $1.5 billion. The wide variation stems from differences in how analysts value his private investments, venture capital holdings, and exposure to public markets.

At his peak during the height of the SPAC boom and strong tech market conditions, Palihapitiya was frequently described as a billionaire, with some estimates placing his net worth well above $2 billion. However, market downturns, declining valuations of several SPAC-backed companies, and broader corrections in technology stocks contributed to a noticeable decline in his overall wealth. Unlike traditional executives with stable salaries, much of his fortune is tied to equity positions that can rise or fall sharply with market sentiment.

A major factor affecting Chamath Palihapitiya’s net worth is the illiquid nature of his assets. Many of his investments are held through Social Capital in private companies, making their true value difficult to assess until a liquidity event such as an IPO or acquisition occurs. Additionally, his public holdings—particularly stakes in companies like SoFi—are subject to ongoing price volatility.

Despite these fluctuations, Palihapitiya remains among the wealthiest figures in venture capital. His financial position continues to evolve based on investment performance, market cycles, and new opportunities, reinforcing the idea that his net worth is not static but constantly in motion.

Early Life and Background

Chamath Palihapitiya’s early life played a crucial role in shaping the mindset that later fueled his financial success. He was born in Sri Lanka in 1976 during a period of political instability. When he was a young child, his family immigrated to Canada, seeking better economic opportunities and long-term security. Like many immigrant families, they faced financial constraints, which exposed Palihapitiya early on to the realities of limited resources and the importance of self-reliance.

Growing up in Canada, Palihapitiya has often spoken about feeling like an outsider and developing a strong drive to succeed. His father worked multiple jobs, and Chamath himself took on part-time work during his teenage years to help support his family. These formative experiences helped instill a deep appreciation for financial independence and long-term thinking—values that later defined his investment philosophy.

Academically, Palihapitiya showed a strong aptitude for science and technology. He went on to attend the University of Waterloo, where he earned a degree in Electrical Engineering. The university is known for producing top-tier engineering and technology talent, and the rigorous curriculum helped sharpen his analytical and problem-solving skills. During his studies, he developed a keen interest in how technology could scale rapidly and disrupt traditional industries.

His immigrant background, technical education, and early exposure to financial hardship collectively shaped his worldview. Rather than pursuing a conventional career path, Palihapitiya became focused on leveraging technology and capital to create outsized outcomes—both financially and socially. These early influences laid the groundwork for his later rise in Silicon Valley and the accumulation of his net worth.

Career Beginnings and Early Income

Before becoming a well-known venture capitalist, Chamath Palihapitiya built his career through a series of early roles in the technology industry that helped him develop both technical expertise and business acumen. After graduating from the University of Waterloo, he entered the tech workforce during the early 2000s, a period marked by rapid innovation and the aftermath of the dot-com bubble. These conditions exposed him to both the risks and rewards of working in fast-moving technology companies.

One of Palihapitiya’s most notable early roles was at AOL, where he worked on the Winamp music platform. At the time, Winamp was one of the most popular digital media players in the world, and his work there provided valuable insight into user behavior, product growth, and scalable internet platforms. While his early income during this phase was modest compared to his later wealth, it laid the foundation for his understanding of consumer technology and network effects.

These formative professional experiences helped Palihapitiya develop a growth-oriented mindset that would later define his career. He became increasingly interested in how products spread organically and how user acquisition could drive exponential value. This focus on growth eventually caught the attention of major Silicon Valley players and opened the door to higher-impact opportunities.

Although Palihapitiya was not wealthy during his early career, he was steadily building valuable skills and industry connections. His time at AOL and similar tech environments positioned him for his breakthrough role at Facebook, where equity compensation and rapid company growth would dramatically change his financial trajectory. These early career steps were instrumental in transforming him from a salaried employee into a future tech multimillionaire.

Facebook Era: Foundation of His Wealth

Chamath Palihapitiya’s time at Facebook marked the most transformative period of his career and laid the foundation for the majority of his net worth. He joined Facebook in 2007, when the company was still in its early growth phase and far from becoming the global tech giant it is today. Palihapitiya quickly rose through the ranks and became Vice President of User Growth, a role that placed him at the center of Facebook’s expansion strategy.

In this position, he focused on scaling Facebook’s user base internationally, helping the platform grow from tens of millions of users to hundreds of millions worldwide. His work on growth mechanics, engagement loops, and data-driven expansion was instrumental in Facebook’s dominance in the social media space. This contribution significantly increased the company’s valuation and, in turn, the value of the equity held by early executives like Palihapitiya.

A major driver of Chamath Palihapitiya’s net worth was his stock compensation during his Facebook tenure. As an early executive, he received substantial equity grants, which appreciated dramatically as Facebook approached its 2012 initial public offering. Although exact figures have never been publicly disclosed, his Facebook shares reportedly made him financially independent before the age of 35.

Palihapitiya left Facebook in 2011, one year before the IPO, but retained a sizable stake in the company. The liquidity and wealth generated during this period gave him the freedom to pursue venture capital on his own terms. Without the financial success of Facebook, his later investments, risk-taking, and founding of Social Capital would not have been possible. This era remains the single most important contributor to his long-term wealth accumulation.

Founding Social Capital

After leaving Facebook in 2011, Chamath Palihapitiya founded Social Capital, a venture capital firm built on a mission that went beyond traditional profit-driven investing. Armed with the financial independence he gained from Facebook, Palihapitiya set out to deploy capital in a way that combined long-term value creation with social impact. Social Capital initially focused on backing early-stage technology companies with the potential to disrupt large, inefficient industries.

Under Palihapitiya’s leadership, Social Capital invested in startups across sectors such as enterprise software, healthcare, education, and financial services. The firm quickly gained attention for its founder’s outspoken criticism of short-term thinking in Silicon Valley and his emphasis on sustainable growth. Unlike many venture firms that prioritized rapid scaling and quick exits, Social Capital aimed to support companies over longer time horizons.

Over time, the firm’s structure evolved. Palihapitiya transitioned Social Capital away from a traditional venture capital model funded by outside limited partners and toward a capital-as-a-service approach, investing primarily his own money. This shift gave him greater control over investment decisions and reduced external pressure, but it also concentrated risk directly on his personal net worth.

Social Capital became a major contributor to Chamath Palihapitiya’s wealth through both private investments and public market exposure. Some portfolio companies delivered strong returns, while others struggled amid changing market conditions. Because many of these holdings are private, their valuations are difficult to assess, adding uncertainty to estimates of his overall net worth.

Despite criticism and internal changes at the firm, Social Capital remains central to Palihapitiya’s identity as an investor. It represents both his philosophical approach to capital allocation and a significant pillar of his financial empire.

Venture Capital Investments

Beyond Facebook and Social Capital’s founding, Chamath Palihapitiya built much of his reputation—and net worth—through high-profile venture capital investments. He became known for identifying companies with strong product-market fit and the potential to scale rapidly, often investing at early or growth stages. These bets played a key role in expanding his influence within Silicon Valley and beyond.

Palihapitiya has been associated with investments in notable technology companies such as Slack, Box, Yammer, and SurveyMonkey, among others. While not every investment delivered outsized returns, several of these companies achieved successful exits through acquisitions or public offerings. These wins helped compound his wealth and reinforced his image as a savvy investor with an eye for disruptive platforms.

In addition to enterprise software, Palihapitiya showed strong interest in healthcare and fintech, sectors he believed were ripe for technological transformation. Investments in these areas aligned with his broader thesis that technology could improve access, efficiency, and outcomes in industries traditionally resistant to change. Some of these bets required longer time horizons, meaning their true contribution to his net worth may not yet be fully realized.

However, venture capital is inherently risky, and not all of Palihapitiya’s investments performed well. Market shifts, regulatory challenges, and changing investor sentiment affected returns across his portfolio. Because venture investments are often illiquid, gains and losses may not immediately reflect in public net worth estimates.

Overall, Palihapitiya’s venture capital activity significantly shaped both his financial standing and public persona. The successes strengthened his billionaire status during peak market cycles, while the underperforming investments highlighted the volatility that continues to define his wealth trajectory.

SPACs and Public Market Influence

Chamath Palihapitiya became a household name among retail investors largely due to his aggressive involvement in special purpose acquisition companies (SPACs). During the peak of the SPAC boom between 2020 and 2021, he sponsored multiple blank-check companies that raised billions of dollars and took private firms public at record speed. This strategy significantly boosted his visibility—and, at its peak, his net worth.

Some of the most notable companies taken public through Palihapitiya-backed SPACs include Virgin Galactic, SoFi, Opendoor, and Clover Health. Early enthusiasm surrounding these deals drove sharp increases in share prices, which temporarily elevated the value of his equity stakes. At the height of the SPAC frenzy, these holdings contributed heavily to estimates placing Chamath Palihapitiya firmly in billionaire territory.

However, the SPAC market proved highly volatile. As investor sentiment shifted and regulatory scrutiny increased, many SPAC-backed companies saw substantial declines in their stock prices. Several of Palihapitiya’s high-profile deals underperformed expectations, leading to criticism from investors and the media. These downturns resulted in significant paper losses and played a major role in the decline of his net worth from peak levels.

Despite the backlash, Palihapitiya defended SPACs as an alternative path to public markets and emphasized long-term value over short-term price movements. While some investments struggled, others continue to evolve as operating businesses. Overall, his SPAC involvement remains one of the most influential—and controversial—chapters in his financial story, demonstrating how public market exposure can rapidly amplify both wealth creation and wealth erosion.

Public Stock Holdings

Public stock holdings represent another important component of Chamath Palihapitiya’s net worth, particularly because these assets are more transparent and subject to daily market valuation. Unlike private venture investments, publicly traded equities fluctuate in real time, which means changes in stock prices can quickly impact estimates of his overall wealth.

One of Palihapitiya’s most closely watched public positions has been his stake in SoFi Technologies, a fintech company that went public through a SPAC sponsored by Social Capital. At various points, Palihapitiya held a significant ownership position in SoFi, making it a meaningful contributor to his net worth. However, as with many growth-oriented tech stocks, SoFi’s share price has experienced sharp ups and downs, directly affecting the value of his holdings.

In addition to SoFi, Palihapitiya has held or disclosed positions in other publicly traded companies connected to his SPAC activity and investment portfolio. These holdings are often tracked through SEC filings, which provide insight into insider ownership, share sales, and changes in position sizes. While these disclosures offer partial visibility, they do not always reflect his full exposure, as some positions may be held indirectly through funds or investment vehicles.

Market volatility has played a major role in shaping the value of Palihapitiya’s public assets. Broader sell-offs in technology stocks, rising interest rates, and shifting investor sentiment toward growth companies have periodically reduced the value of his portfolio. Conversely, market rebounds and improved company fundamentals can quickly restore value.

Private Assets and Hidden Wealth

A significant portion of Chamath Palihapitiya’s net worth is tied to private assets, which are often referred to as “hidden wealth” due to their lack of public pricing and limited disclosure. Unlike publicly traded stocks, private investments are not valued daily, making them difficult for analysts to assess accurately. As a result, estimates of Palihapitiya’s wealth can vary widely depending on how these assets are valued.

Through Social Capital, Palihapitiya holds stakes in numerous private startups across technology, healthcare, and financial services. Some of these companies are still in early or growth stages, meaning their valuations are based on funding rounds rather than open market trading. If these businesses achieve successful exits through acquisitions or initial public offerings, they could substantially increase his net worth. Conversely, underperformance or failed startups could reduce the value of these holdings.

In addition to startup equity, Palihapitiya is believed to have ownership interests in venture funds and investment vehicles that further complicate valuation. These structures often include carried interest and long-term performance-based compensation, which may not be immediately reflected in standard net worth estimates. This creates a gap between reported figures and the true economic value of his portfolio.

Private wealth also allows for strategic flexibility. Because these assets are not subject to short-term market sentiment, Palihapitiya can take a longer-term approach to value creation. However, the lack of liquidity means capital can be locked up for years, increasing risk during economic downturns.

Ultimately, private assets represent both the most uncertain and potentially most rewarding component of Chamath Palihapitiya’s net worth. Their opaque nature ensures that any publicly reported figure is, at best, an informed approximation rather than a precise calculation.

Conclusion

Chamath Palihapitiya’s net worth reflects the modern reality of technology driven wealth dynamic, volatile, and deeply tied to market cycles. From his early days as an immigrant with limited resources to becoming a Facebook executive and venture capitalist, his financial journey illustrates how access to equity, timing, and risk tolerance can create extraordinary outcomes. The foundation of his wealth was built during Facebook’s explosive growth, which provided him with both capital and credibility to pursue larger ambitions.

Through Social Capital, Palihapitiya positioned himself as a long-term investor focused on systemic change, backing companies across technology, healthcare, and financial services. His rise to prominence during the SPAC boom further amplified his influence and net worth, though it also exposed him to heightened scrutiny and significant downside risk when market sentiment shifted. As a result, his wealth has experienced notable peaks and declines rather than steady growth.

Unlike traditional billionaires with diversified and transparent holdings, a large portion of Chamath Palihapitiya’s net worth remains tied to private investments and equity-based compensation. This makes precise valuation difficult and ensures that estimates will continue to fluctuate. Despite setbacks, he remains financially powerful, influential, and deeply embedded in the venture capital ecosystem.

Ultimately, Chamath Palihapitiya’s net worth is not just a number—it is a reflection of bold bets, controversial decisions, and a willingness to embrace uncertainty. Whether his wealth grows or contracts in the future will depend on market conditions, investment outcomes, and his continued ability to identify transformative opportunities.

Frequently Asked Questions

What is Chamath Palihapitiya’s net worth?

Chamath Palihapitiya’s net worth is estimated to range between $600 million and $1.5 billion, depending on market conditions and asset valuations.

Is Chamath Palihapitiya a billionaire?

He has been considered a billionaire during peak market periods, particularly during the SPAC boom, though his net worth has fluctuated below that level at times.

How did Chamath Palihapitiya make his money?

He made most of his money through Facebook stock, venture capital investments, Social Capital, and SPAC-sponsored public companies.

What role did Facebook play in his wealth?

Facebook was the foundation of his wealth, providing early equity that appreciated significantly before and after the company’s IPO.

Did Chamath Palihapitiya lose money on SPACs?

Some SPAC-backed companies underperformed, leading to losses, but others continue operating and may recover over time.

What companies has he invested in?

His investments include companies like SoFi, Virgin Galactic, Opendoor, Clover Health, and numerous private startups.

Does Chamath Palihapitiya still invest today?

Yes, he remains active through Social Capital and continues to participate in private and public market investments.